We Find & Remove Credit Card Processing Junk Fees and Optimize Interchange

We Find & Remove Credit Card Processing Junk Fees and Optimize Interchange

Reducing Your Merchant Processing Costs by 40% or More!

What We Do

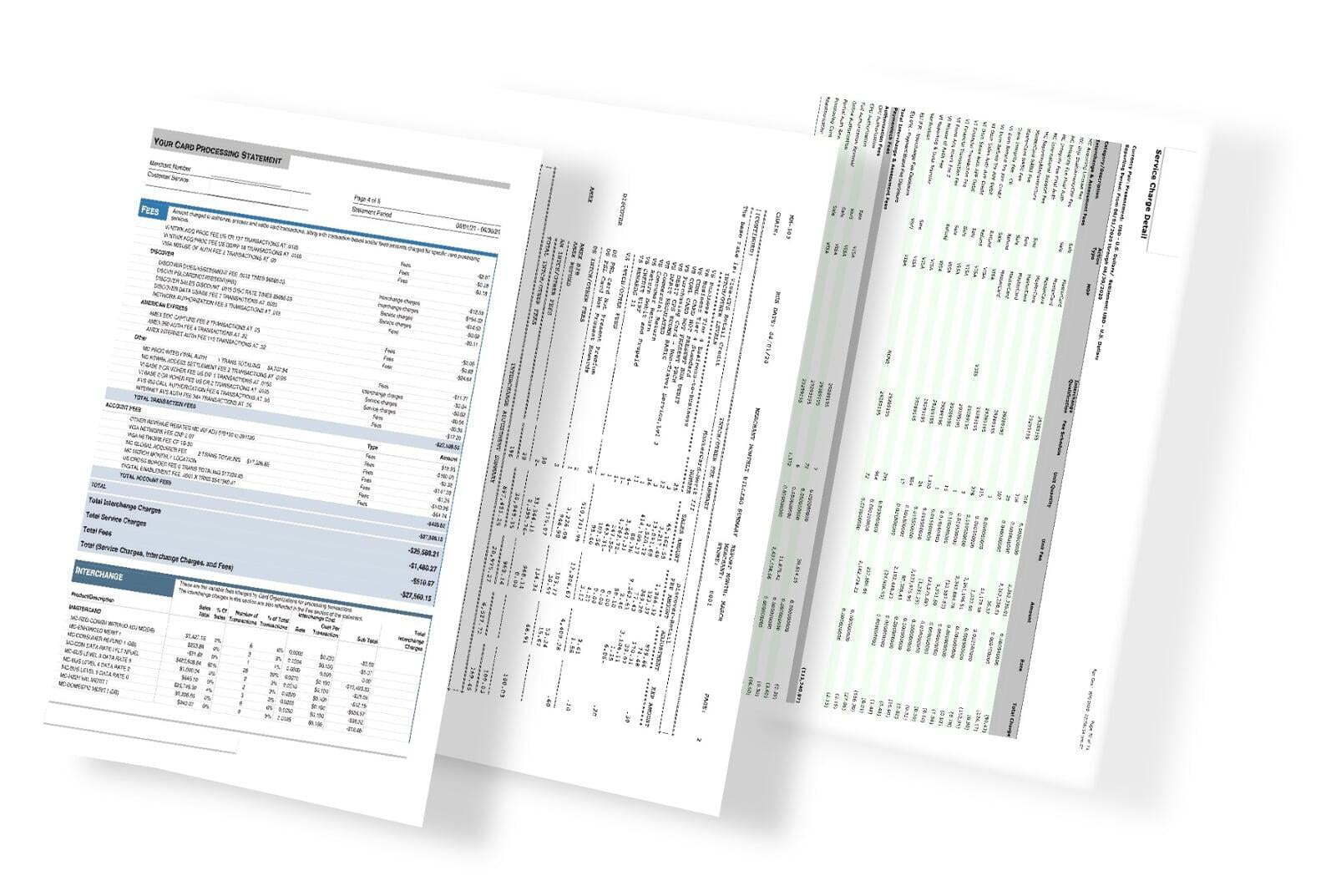

Merchant Processing Audits

Our 10-point comprehensive merchant processing audit is unmatched in the industry delivering the largest savings - GUARANTEED!

Whether your processor is deliberately over-billing merchant processing fees or you are losing money due to mistakes made by the processor, we will find it!

Interchange Optimization™

Interchange makes up between 80 - 90% of a merchant's overall processing cost. Getting transactions to settle at the lowest interchange category is imperative for a merchant who is looking to reduce their processing cost.

Interchange is the most complex component of merchant processing, and they change hundreds of categories every year, exacerbating the situation. It is no wonder we find interchange savings on nearly every audit we do, and it generates the highest savings in 90% of all the audits we do.

Monthly Audits

Monthly audits are a critical component. Most processors will reduce your fees just because you ask. However, on the first page of every merchant agreement is a clause that states they can change fees at any time and you have 90 days to catch it and dispute it. If you don't resolve within those 90 days and continue to process transactions, it means you have agreed with the new fees and given up your right to dispute them. Check out this Case Study

Therefore, it is critical to have your merchant processing statements audited each month to ensure all processing fees align and are consistent with the fees defined in your restructured agreement.

If your credit card processor takes one penny too much, we will catch it and get it back.

Think you don't

need an audit?

Take our audit challenge to see if you can find the $80,415 in overbillings.

Instead of saying things like "EIRF" (Electronic Interchange Reimbursement Fee), why don't they just say you did not enter the zip code?

Our clients receive statements that convert Greek into English, allowing them to see what they are really being charged for.

You cannot control what you don't understand.

As Seen

What Our Clients Are Saying

Trevor Gleeson - Treasurer, Facebook

Why Merchants Choose Us

No one else does what we do.

Get Your Free Audit - And Find Out How Much You Are Being Overbilled

No strings attached - No credit card needed.

We take the “big box” grocer approach - we will give you a free cookie in hopes that you will want to buy the whole bag when you see what we are able to show you.

What does the bag cost? Click here to see our transparent pricing.

And just like those guys - we also have an amazing return policy!

Make sure to check out our FAQ