After you receive the free audit request, you can send them this link to collect the rest of the information.

To be clear- this info is not required, but it will ensure we are not wasting time on deals that may not be able to be done due to ERP limitations, etc. As well as it will allow us to give a more accurate forecast, but the biggest reason you want this is becuse we have had audits fall apart becuse they felt we were not prepared becuse we did not know enough about them. https://www.weaudit.com/how-do-you-process/

They were not even an ISO (Independent Sales Organization) until a couple of months ago (sometime during the first half of 2024). Before that, they were not even approved by the processing networks (Visa, Mastercard, Discover, American Express) to sell merchant processing services, but that did not stop them from selling it. Our guess is that they had no idea that they had to become a registered ISO. Below is a screenshot where they referred to themselves as a “processing Service,” which there is no such thing as a “processing Service”. But they do acknowledge that they are just reselling FISERV.

There is nothing unique about them; they are just like all the other ISO’s for Fiserv (Formerly First Data). As of today 1/22/25.

1– Forced Gateway options – just like Worldpay

Other ISOs will let merchants use whatever gateway they want, but EPX requires them to use its antiquated, outdated gateway. Thus, their interchange issues will remain as they are.

2 – Promising to raise rates

We found this on one of the audits we did – This means they can raise their Discount Rates, Auth Fees, and AVS up to 10% with the April update. Please note that these updates are every April and October! This would imply that those fees could increase up to 20% per year or double every five years.

3 – Potential wrong setup – setting up merchants as retail versus B2B Card Not Present.

Even though the bulk of Eclipse and P21 are B2B AND CARD NOT PRESENT transactions – they consider they consider their system to be a retail solution. Which creates more interchange downgrades

4 – Junk Fee # 1 Infating American Express Fees

Below, the top line shows where they are charging an Amex Direct merchant over 39 basis points for an Amex transaction. Other processors fee for this is ZERO! So, if you did have a low discount rate of 4-5 basis points, you would have to factor in the additional 39+ basis points back into that deal. This is costing this merchant over $600 a month and they have no idea!

5 – Junk Fee # 2 Made up fee “AVS WATS Fee”

See the second arrow above. In the second line, they are charging an AVS WATS Fee. Watts fees have not been charged for well over a decade. See below – it is for long distance. Today, everything is done via the internet; no system dials a 1- 800 line, and even if it did, there are no more long-distance fees. This is just a made-up fee.

WATS (Wide Area Telephone Service) was introduced in 1961 by Bell Systems as a long-distance flat-rate plan in which businesses could obtain a dedicated line with an included number of hours of call time from specific long-distance areas.

6 – Inflating PCI Fees

Again, see the image above – the third arrow – Charging $40 per mid / per month, a business with 20 locations would pay $800 for PCI compliance. Versus only $8.95 per mid / per month.

7 – I/C Savings adjustment

See the fourth line down from the top in the above image. They force businesses to use an antiquated payment gateway that creates many transactions to downgrade, costing businesses tens and sometimes several hundred thousand dollars in interchange downgrade fees. However, they offer to fix it on the backend before sending the file to the processing networks if the merchant agrees to let them keep 75% of the savings. Click here to read more about how that works.

8 – Other fees we found on their statements

Monthly Fees – Customer Service Fee – Average Discount Rates 20 – 33 basis points

9 – Black Rated (our internal rating systems)

We rate ISO/Precsccors

Green – Some trust and are truthful most of the time

Yellow – Caution – we see more deception than than normal, but not that bad.

Red – Extrem caution – way more deception than most!

Black – ZERO trust!

| They focus on auditing a single fee and take 50% of the savings, with no guarantees. Founded in 2016, their CEO worked as a merchant processing sales rep for only 16 months before launching Audit Advantage five years later. Additionally, the CEO holds a full-time job he’s been at for 20 years. They are not accredited by the Better Business Bureau (BBB). |

| They claim to be experts in everything a company pays for—shipping fees, HR fees, utility fees, and more—but in reality, they aren’t experts in any of these areas. Instead, they act as audit brokers, outsourcing the actual work to companies like ours. This means they have the least experience of all. Their business model is more like an Amway-style operation, with most employees holding other full-time jobs, making this a part-time gig. They offer no guarantees and were founded in 2013. Bill Kurtzner, their managing partner’s LinkedIn profile, states he was the VP of “VP Merchant Services,” yet no such company exists, and his job post is not linked to any legitimate entity. This raises serious questions about the validity of his experience, expertise, and credibility. |

| They charge 50% of the savings they claim to generate and boast about saving their clients $300 million, which would mean they’ve made at least $150 million. This seems highly unlikely! Founded in 2007, their CEO, Eric Cohen, has no listed work experience on his LinkedIn profile. Instead, his experience section vaguely claims he is “Skilled in Electronic Payments, Payment Systems, E-commerce, Mobile Payments, and Credit Cards,” without any supporting details of actual industry experience. |

They claim to reduce interchange – however, they have zero industry experience. Their CEO, Jeremy Layton, was the owner of JTP & Associates, Inc. before shutting that company down and starting Verisave, and while JTP & Associates says they, too, were a credit card reduction company. Nothing else is on his work history. It is as if this was his first job out of college. It shows he graduated from college in 2000 and started JTP & Associates in 2021- so when did he become an expert on merchant processing and, more importantly, credit card interchange? They take 50% of the savings. No guarantees. They are not BBB accredited. |

| They are single-fee focused and take 50% of the savings. No guarantees. They started in 2017. They have no industry experience. Their CEO, Tony Bolduc, was an Assistant Intern Productions Assistant Intern at Amherst Media before starting this company – They are not BBB accredited. |

We are ranked first in:

Largest Savings – Lowest Fees – Client Satisfaction – Client Retention – Pricing Transparency and Guarantees.

weAudit delivers the largest savings in the industry. With all 5-star reviews and zero BBB complaints, we stand out for our commitment to customer satisfaction. We’re the only company in this space offering a money-back guarantee, operating on a month-to-month basis and not taking a percentage of your savings. Plus, we openly list our fees on our website for full transparency.

The other companies in this space rely on third-party companies to do their audits due to their lack of experience and comprehension of this industry. Only two companies in this space have any industry expertise.

The weAudit leadership team has over 135 years of executive experience from the world’s largest processor. The other company’s experience is limited to one former sales rep with a few years in the field.

Some of the world’s largest companies turn to weAudit to help reduce their credit card processing fees, and we’re the only auditing firm that specializes solely in this area.

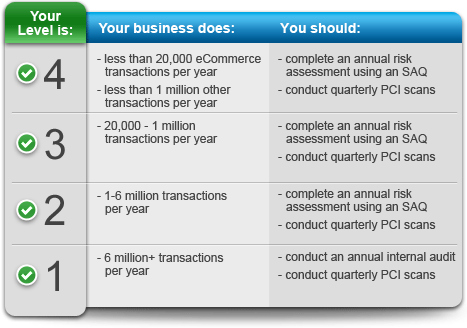

PCI stands for PCIDSS (Payment Card Industry Data Security Standards). All merchants must comply with these standards.

The specific requirements vary based on how many transactions a merchant processes annually. Some merchants only need to submit a questionnaire, while others must undergo additional steps like network scans.

Most merchants are deemed non-compliant simply because they don’t submit the required documentation. Why? Often, they don’t know which form to complete, where to find it, or how to submit it.

This is where we step in. We guide merchants through the process, helping them identify the right form, fill it out, and submit it through our PCI partner, Sysnet (now known as Viking Cloud). We charge $8.95 per location/MID per month, whereas Sysnet charges around $30 per month if purchased directly. We resell this at cost as a courtesy to our clients.

The real issue arises when a merchant experiences a data breach:

- If they are compliant, they are only liable for actual damages.

- If they are non-compliant, the processing networks will impose much heavier fines.

In short, compliance is more about submitting the necessary paperwork than about specific business practices.

Discount Rate – Is the processor’s markup on a transaction. Most of our clients pay around 5 basis points. We see most merchants pay 20 -70 basis points or more on average. This can be negotiated.

Dues & Assessments – This is the fee from the processing networks (Visa, MC, Discover and Amex) and usually runs around 13 basis points, with Amex being a little higher. These can NOT be negotiated.

Interchange Fees – Several things determine the fee, and there about one thousand options in all.

Industry – A hotel has different rates than a grocery store which is different than a distributor, or even an airline.

Card Type – Rewards, Non-Rewards, Regulated Debit, Non Regulated Debit, Purchasing, Corporate, Business, High Rewards cards like Signature or World Card: there are dozens of different card types.

Network – Visa, MC, Discover, & Amex – each network has its own fees as well as rules to get those fees.

How entered –

Keyed

Consumer cards (personal cards) have a higher interchange fee when keyed, versus swiped.

Commercial (business cards) like Purchasing, Corporate, Business cards don’t need to be swiped to get the best rates.

Swiped

Data Passed – The more data passed the lower the rates on Commercial (business cards) like Purchasing, Corporate, Business cards. Many gateways only pass the minimum data, which causes the transaction to clear at a higher interchange rate as opposed to gateway that passes all of the data.

On Commercial cards, you only need to pass the 6 basic fields to get Level II. However, a good gateway will pass over 30 fields to get the transaction to Level III – one of the lowest interchange fees.

Very large companies (such as an airline) can negotiate their own interchange rates.

As seen on

Want to talk?

- Call us today 800-672-1292

- Book a free consultation